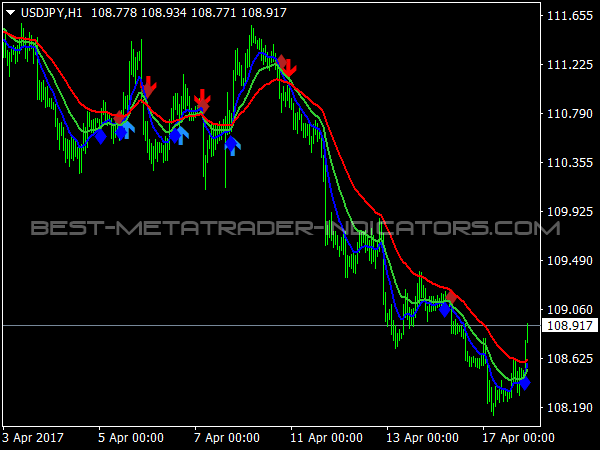

This is because they are used to create specific indicators. It is most common for traders to quote and utilize 12- and 26-day EMAs in the short-term. Short-term averages, on the other hand, is a different story when analyzing Exponential Moving Average data. Analyzing these points and data streams correctly will help the trader determine when they should buy, sell, or switch investments from bearish to bullish or vice versa. An experienced trader will know to look both at the line the EMA projects, as well as the rate of change that comes from each bar as it moves to the next data point. It’s best to use the EMA when for trending markets, as it shows uptrends and downtrends when a market is strong and weak, respectively. For example, by choosing 10-day and 200-day moving averages, a trader is able to determine more from the results in a long-term trade, than a trader who is only analyzing one EMA length. It is common to use more than one EMA length at once, to provide more in-depth and focused data. Additionally, the EMA tries to amplify the importance that the most recent data points play in a calculation. Similar to other moving averages, the EMA is a technical indicator that produces buy and sell signals based on data that shows evidence of divergence and crossovers from general and historical averages.

Indicator for ema stock crossover plus#

The Exponential Moving Average is equal to the closing price multiplied by the multiplier, plus the EMA of the previous day and then multiplied by 1 minus the multiplier.ĮMA = Closing price x multiplier + EMA (previous day) x (1-multiplier) Takeaways To calculate the EMA, follow this simple formula.

The more a trader increases the smoothing factor value, the more influence the most recent data will have on the moving average. This value gives more credibility to the most recent data points available. Although there are many options to choose from when considering the smoothing factor, most opt for a value of 2.

0 kommentar(er)

0 kommentar(er)